Plumb Balanced Fund Earns Five Stars; Equity Fund Earns Four Stars: “The funds have maintained a disciplined investment strategy that has served shareholders very well.”

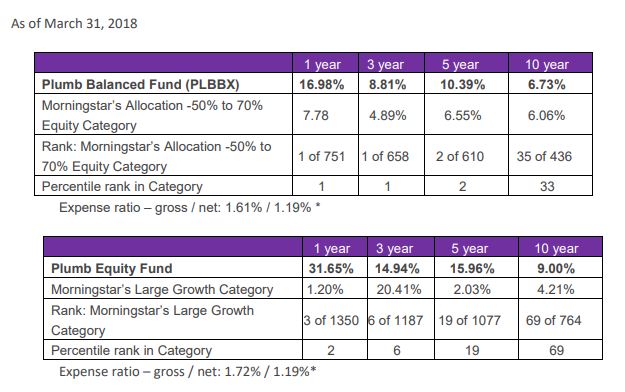

Madison, WI (April 19, 2018) – The Plumb Balanced Fund (PLBBX) received a five-star overall rating from Morningstar among 680 funds in Morningstar’s Allocation -50% to 70% Equity Category as of March 31, 2018. The Plumb Equity Fund (PLBEX) received a four-star overall rating among 1213 funds in the Large Growth Category also as of March 31. The funds are part of Wisconsin Capital funds, which began offering their investment strategies as mutual funds in May 2007.

“We are very proud of both of our funds’ track records and solid performance for their shareholders,” said Tom Plumb, president and CIO of Plumb Funds and CEO of the adviser. “The funds have maintained a disciplined investment strategy that has served shareholders very well.” Plumb Funds invest in companies they believe are market leaders who possess long term profit viability, entrenchment in their market, and innovation with major sector disruption potential. They take into account a mosaic of qualitative features to determine not only which stocks to buy, but when to buy them.

“We believe the Plumb Balanced Fund is distinctive, in that it is growth oriented,” added Plumb. The fund follows the premise that its equities should be growth oriented while its bond investments should be focused on moderating risk, while also providing the potential to generate consistent returns. This follows our core belief that companies in secular growth trends may not only see their stock prices grow over time, but exhibitive defensive characteristics that may provide the potential for these stocks to outperform in challenging stock market environments. This growth-oriented approach also carries over into the Plumb Equity Fund, where the patiently aggressive strategy is adapted for equity focused investors.

“For Morningstar to recognize The Plumb Balanced Fund with its top overall rating is very exciting,” said Plumb “With this fund at five stars, we are proud that the fund family has two quality mutual funds with four or five stars as rated by Morningstar.”

More information and current performance are available at plumbfunds.com or by clicking here: Plumb Balanced Fund Plumb Equity Fund

Performance data quoted represents past performance and does not guarantee future results.

Investment returns and principal value will fluctuate, and when sold, may be worth more or less than

their original cost. Performance current to the most recent month-end may be lower or higher than

the performance quoted and can be obtained by calling 866-987-7888.

About Plumb Funds

The Plumb Funds are advised by Wisconsin Capital Management. Since 1984, Wisconsin Capital

Management has provided individual portfolio management to individuals, companies, institutions,

independently and in the past, as an affiliate. Beginning in 2005, Wisconsin Capital began offering

mutual funds, with the hope of bringing clients the advantages of their investment discipline, through

the convenience of a mutual fund structure.

For more information about Plumb Funds or Wisconsin Capital Management, please call 866-987-7888

or visit the website at plumbfunds.com.

Mutual fund investing involves risk. Principal loss is possible.

The Funds may invest in smaller companies, which involve additional risks such as limited liquidity

and greater volatility. The Funds may invest in foreign securities which involve greater volatility and

political, economic and currency risks and differences in accounting methods. Growth stocks typically

are more volatile than value stocks; however, value stocks have a lower expected growth rate in

earnings and sales. Temporary Defensive Positions: Under adverse market conditions the Fund could

invest a substantial portion of its assets in US Treasury securities and money market securities which

could reduce the benefit from any upswing in the markets.

The Plumb Balanced Fund will invest in debt securities, which typically decrease in value when

interest rates rise. This risk is usually greater for longer-term debt securities. Investments in Asset

Backed and Mortgage Backed Securities include additional risks that investors should be aware of

such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility

to adverse economic developments. The Fund may engage in short-term trading, which could produce

higher transaction costs and taxable distributions and lower the fund’s after tax performance.

*The advisor has contractually agreed to waive fees through 7/31/18. Investment performance reflects fee waivers. In the absence of these waivers, returns would be

reduced.

The funds’ investment objectives, risks, charges, and expenses must be considered carefully before

investing. The prospectuses contains this and other information about the funds. You may obtain a free

hard-copy version by calling 1-866.987.7888 or you may download a prospectus here. Read it carefully

before investing.

The Plumb Funds are distributed by Quasar Distributors, LLC.

Wisconsin Capital Management, the advisor to the funds, is a registered investment advisory firm based

in Madison, Wisconsin, founded in 1984. Plumb Funds is a registered trademark of Wisconsin Capital

Funds, Inc.

Morningstar Ratings for the Plumb Balanced Fund (PLBBX) as of 3/31/2018, among moderate target risk

funds: 3-yr (5 stars / 680 funds), 5-yr (5 stars / 628), 10-yr (4 stars / 442), for the Plumb Equity Fund

(PLBEX) as of 3/31/2018, among large growth funds: 3-yr (5 stars / 1213 funds), 5-yr (4 stars / 1099), 10-

yr (3 stars / 779).

The Morningstar Rating™ for funds, or “star rating,” is calculated for mutual funds, variable annuity and

variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least

a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single

population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return

measure that accounts for variation in a managed product’s monthly excess performance, placing more

emphasis on downward variations and rewarding consistent performance. The top 10% of products in

each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the

next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a

managed product is derived from a weighted average of the performance figures associated with its

three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year

rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months

of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more

months of total returns. While the 10-year overall star rating formula seems to give the most weight to

the 10-year period, the most recent three-year period has the greatest impact because it is included in

all three rating periods.

Morningstar Absolute Rankings represent a fund’s total-return rank relative to all funds that have the

same Morningstar Category. The highest rank is 1 and the lowest is based on the total number of funds

ranked in the category. It is based on Morningstar total return, which includes both income and capital

gains or losses and is not adjusted for sales charges or redemption fees. Morningstar Percentile

Rankings represent a fund’s total-return percentile rank relative to all funds that have the same

Morningstar Category. The highest percentile rank is 1 and the lowest is 100. It is based on Morningstar

total return, which includes both income and capital gains or losses and is not adjusted for sales charges

or redemption fees.

© 2018 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to

Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted

to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for

any damages or losses arising from any use of this information. Past performance is no guarantee of

future results.

Plumb Funds are distributed by Quasar Distributors, LLC.

CATEGORIES

SIGN UP FOR THE PLUMB LINE

STAY UP TO DATE ON OUR CURRENT INSIGHTS AND PORTFOLIOS.