Mutual fund investing involves risk. Principal loss is possible.

The Funds may invest in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Funds may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. Temporary Defensive Positions: Under adverse market conditions the Fund could invest a substantial portion of its assets in US Treasury securities and money market securities which could reduce the benefit from any upswing in the markets.

The Plumb Balanced Fund will invest in debt securities, which typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in Asset Backed and Mortgage Backed Securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The Fund may engage in short-term trading, which could produce higher transaction costs and taxable distributions and lower the fund’s after-tax performance.

Diversification does not assure a profit nor protect against loss in a declining market.

Investment performance reflects fee waivers. In the absence of these waivers, returns would be reduced.

Any tax or legal information provided isn’t an exhaustive interpretation of some of the current income tax regulations. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. Neither the Fund nor any of its representatives may give legal or tax advice.

References to other mutual fund products should not be interpreted as offers of those securities.

The Funds' investment objectives, risks, charges, and expenses must be considered carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free hard-copy version by calling 1-866.987.7888 or you may download a prospectus here. Read it carefully before investing.

The Plumb Funds are distributed by Quasar Distributors, LLC.

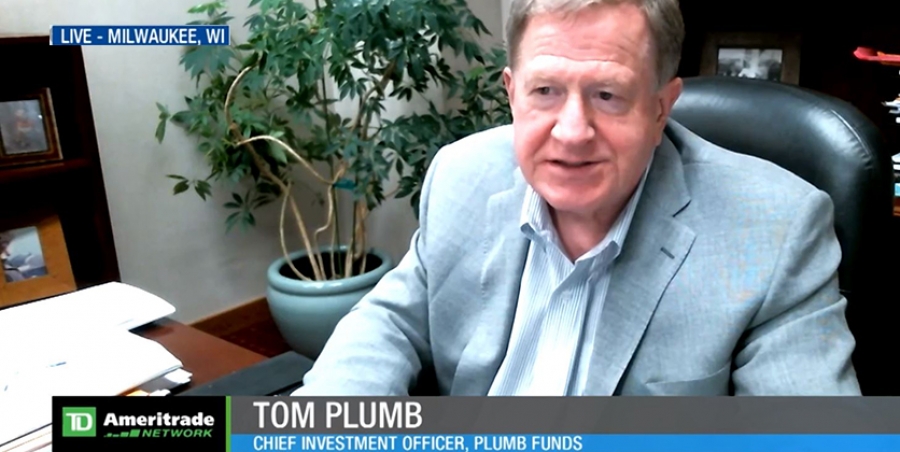

Wisconsin Capital Management, the advisor to the funds, is a registered investment advisory firm based in Madison, Wisconsin, founded in 1984. Plumb Funds is a registered trademark of Wisconsin Capital Funds, Inc.